FNC News

Farmland: A Legacy and an Asset

Farmland as a Legacy

I grew up as the fifth generation on a farm in west central Missouri that has been in my family since 1881. While my kids did not grow up on the farm, they love to spend time there, and it has become a very special place to enjoy together. Many families, like ours, view the family farm as a legacy to enjoy and ultimately pass down to the next generation.

Farmland as an Asset

Land has also proven to be a great investment, and it continues to be an excellent asset class for both investors seeking returns and diversity, and for families to own and hold as a store of wealth. With the sharp increase in land prices in recent years, it is certainly considered a very valuable asset. For instance, a single quarter-section of quality row crop land in the Midwest may now be worth more than $2 million. If handled and set up properly, what was once considered a simple farm may now be a significant asset that can create a valuable family legacy of wealth and income for future generations.

As an investment, land generates modest annual cash returns compared to other investment alternatives. However, when also considering appreciation and tax benefits, land has consistently outpaced many other investment classes in total return over a long period of time. It also performs very well in inflationary environments and can be easily passed down as a family legacy of wealth.

Transfer of Wealth

Is your family prepared for a generational transfer of wealth? According to the recent Iowa State University Land Ownership & Tenure study, two-thirds of land in Iowa is owned by individuals aged 65 and older, of which only 29% was held by this age group in 1982. Additionally, 55% of this land is held by a non-operator who does not currently farm. These trends will drive a continued increase in the volume of land changing hands over the next 25 years. Granted, much of this land will go to the next generation of active farmers, but an increased amount will go to family members who do not actively farm, as well as other non-operators, trusts, and institutions.

Trusts & LLCs

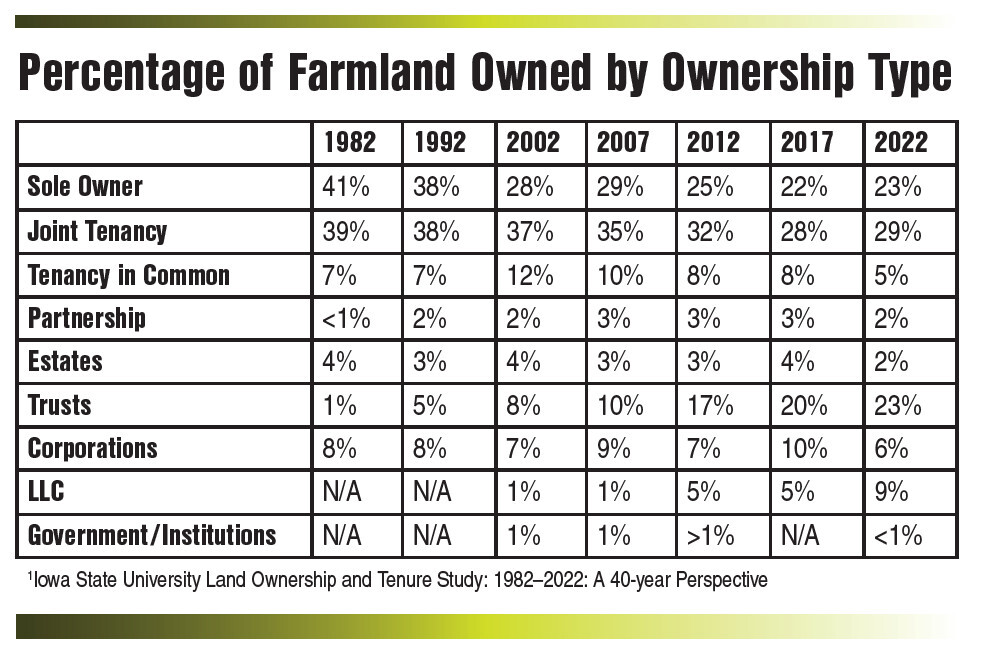

In the same ISU study, Trusts accounted for 23% of land owned in Iowa as of July 2022, while three decades ago almost none was owned in this fashion. Many of these trusts include families with revocable living trusts, corporations, or LLCs, as well as institutions and non-profit organizations. Benefits of setting up a trust to transfer land include owner’s control, and the ability to set clear direction on how their assets are to be managed or divided between multiple beneficiaries. Trusts may also be set up to avoid legal complexity and probate, and capitalize on tax benefits through this transition.

Estate Planning Team

The transfer of land to an increasing number of non-operators, trusts, and institutions requires a greater need for estate planning. An estate planning team often includes a qualified attorney, financial advisor, tax advisor, and professional farm manager when land or other special assets are involved. Farmers National Company provides professional assistance to landowners and families as part of this estate planning team. We also provide multiple resources, webinars, and landowner workshops to assist landowners with this critical need. If you are interested in any of these resources or would like to visit with someone who can help with professional farm management services, please contact us.

More News